Buyers looking for bargains in country towns: ME Property Report

Contact

Buyers looking for bargains in country towns: ME Property Report

Young first home buyers look for COVID-19 bargains including in country towns, according to the latest ME Quarterly Property Sentiment Report.

The new HomeBuilder grants have provided the incentive to young first home buyers to enter the property market and they are ready for some COVID-19 bargains.

This is one of the finding in the latest ME Quarterly Property Sentiment Report.

The report has found 82 per cent of first-time buyers agreed they hoped to see bargain properties for sale if the economy worsens – compared to 66 per cent of investors and 57 per cent of owner occupiers.

At a Glance:

- 82 per cent of first-time buyers agreed they hoped to see bargain properties

- 51 per cent of first home buyers planned to get ontot he property ladder in the next 12 months

- Two-thirds (60 per cent) said they were more likely to consider buying in a regional area

Just over half (51 per cent) of first home buyers, the most of any group, planned to get onto the property ladder in the next 12 months, up 9 points on the previous quarter.

Source: ME Quarterly Property Sentiment Report

Millennials were also the most positive about the current property market by age group (40 per cent).

These are key findings from the sixth edition of ME’s Quarterly Property Sentiment Report, which surveys investors, owner occupiers and first home buyers ahead of each upcoming quarter.

This survey was conducted for Q3 2020 in June when COVID-19 restrictions initially eased across most states and territories.

“First home buyers may be looking to find a silver lining in the current economic climate, thanks to greater potential for property price falls, record low interest rates and government support," said ME General Manager Home Loans, Andrew Bartolo.

"Of course, this will be more realistic for those whose employment and income haven’t been affected as a result of the pandemic.”

Buying regional for the first home buyer

First home buyers may be eyeing off bargains in regional areas because of the pandemic.

Two-thirds (60 per cent) said they were more likely to consider buying in a regional area during COVID-19, to save money and improve their lifestyle, compared to 45 per cent of total respondents overall.

“New remote and flexible working arrangements brought in to accommodate for COVID-19 have clearly influenced Australians’ sentiment towards buying in regional areas," said Mr Bartolo.

"It’s now a more feasible option for many and if prices are lower in those areas and you think it will improve your lifestyle – of course it’s an attractive possibility.

“I think many Australians dream about moving to a regional area at some stage during their life, so it will be interesting to see how many do actually decide to pursue a sea or tree change, perhaps earlier than expected.”

HomeBuilder gets keen buyers in the market

The Federal Government’s HomeBuilder appears to be spurring first home buyer interest.

Over half (52 per cent) of first home buyers said they were interested in applying for the grants, compared to just 33 per cent of existing home buyers.

Overall, 58 per cent of respondents said they thought HomeBuilder would significantly increase activity in the property market.

“With strong interest from first home buyers as seen in the report, hopefully the HomeBuilder grant will help more younger Australians get their foot in the door and increase buying activity in the wider market as a result,” said Mr Bartolo.

Source: ME Quarterly Property Sentiment Report

Uptick in general optimism

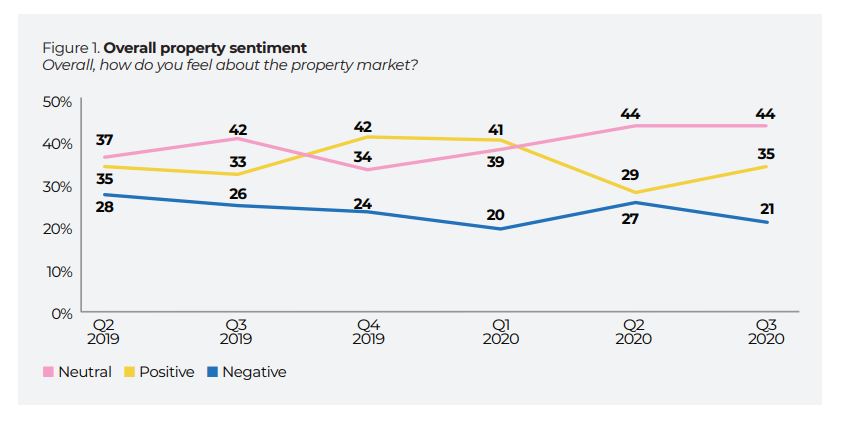

Overall, Australians recovered some optimism about the property market following the initial wave of COVID-19.

Positive sentiment rose to 35 per cent for Q3 2020, up six points from 29 per cent in the previous quarter, but still well below the recent high of 39 per cent in Q1 2020.

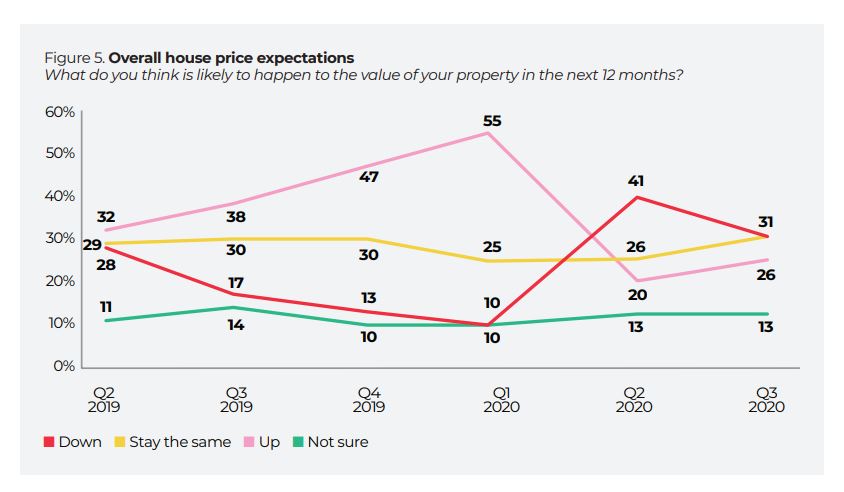

Worries around how COVID-19 would affect the value of property also slightly eased, down 9 percentage points since last quarter to 55 per cent.

However, when asked about their actual property plans over the next 12 months, the majority of Australians (61 per cent) overall are still planning to hold steady and neither buy nor sell, with only 10 per cent in the market indicating they have plans to sell, which was also reflected in the previous quarter.

“The global pandemic continues to shift consumer sentiment and create volatility in the Australian property market, a situation no one would have expected at the beginning of the year," said Mr Bartolo.

"The impact of COVID-19 negatively shifted consumer sentiment towards the property market in the second quarter of the year, but we started to see signs of optimism in June.

“Hopefully this renewed positivity and growing confidence is able to weather possible second waves of COVID-19 cases as we’ve seen in Victoria, which is no doubt increasing worry across the nation.”

Read the ME Quarterly Property Sentiment Report here.

Similar to this:

House price expectations become positive, yet housing affordability remains a big issue

Housing affordability and credit top list of consumer concerns - survey